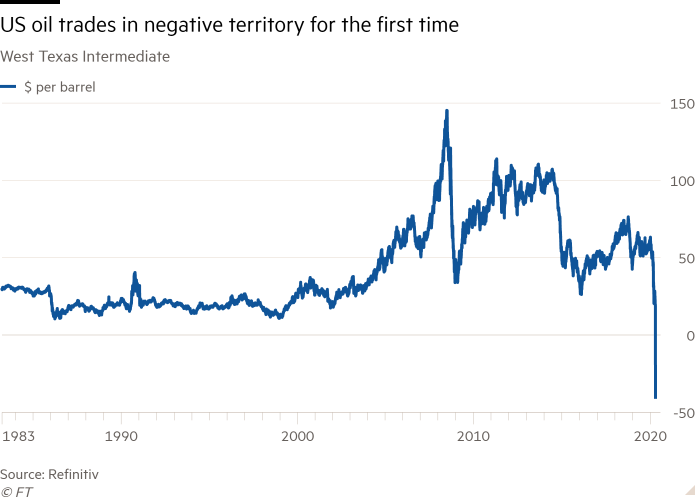

US oil prices turned negative for the first time on record yesterday as North America's oil producers deal an unprecedented oversupply of crude left by the coronavirus crisis.

The price of US crude oil collapsed from $18 a barrel to -$38 in a matter of hours, forcing oil producers to pay buyers to take the glut of crude which they cannot store, as rising stockpiles of crude threaten to overwhelm oil storage facilities.

A record 160 million barrels of oil was being stored in "super-giant" oil tankers outside the world's largest shipping ports, including the US Gulf, following the deepest fall in oil demand in 25 years because of the coronavirus pandemic.

Global oil prices are expected to begin recovering over the second half of the year as tight restrictions on travel to help curb the spread of the virus are lifted, raising demand for fuels and oil.

The world's largest oil-producing nations have agreed a deal to hold back between 10 to 20 million barrels of oil a day from the global market from May, and many oil companies are likely to shut their wells as financial pressures mount.

Yukon RCMP leads the way in body-worn camera deployment

Yukon RCMP leads the way in body-worn camera deployment

Math'ieya Alatini elected CYFN Grand Chief

Math'ieya Alatini elected CYFN Grand Chief

Watson Lake man charged in firearm robbery

Watson Lake man charged in firearm robbery

House fire in McIntyre contained

House fire in McIntyre contained

RCMP plane crash caused by faulty sensor: TSB report

RCMP plane crash caused by faulty sensor: TSB report

New Fireweed Mental Health unit opens at Whitehorse General Hospital

New Fireweed Mental Health unit opens at Whitehorse General Hospital

Traditional learning camp opens at Whitehorse school

Traditional learning camp opens at Whitehorse school

Yukon Schools introduce online registration for bus service

Yukon Schools introduce online registration for bus service

Yukon Government unveils progress in healthcare transformation with 2024 Putting People First annual report

Yukon Government unveils progress in healthcare transformation with 2024 Putting People First annual report

Whitehorse Emergency Shelter unveils New Artwork celebrating Yukon First Nations culture

Whitehorse Emergency Shelter unveils New Artwork celebrating Yukon First Nations culture

Former Whitehorse City Councillor Ted Laking announces bid for Yukon Party nomination in Porter Creek Centre

Former Whitehorse City Councillor Ted Laking announces bid for Yukon Party nomination in Porter Creek Centre

Yukon Government seeks applicants for new Health Authority Board

Yukon Government seeks applicants for new Health Authority Board

Canada Post strike looms, Yukoners brace for disruption

Canada Post strike looms, Yukoners brace for disruption

Driver charged in fatal collision that killed Yukon Government Deputy Minister and injured Minister

Driver charged in fatal collision that killed Yukon Government Deputy Minister and injured Minister

Yukoners encouraged to apply for Northwestel's Northern Futures Scholarship Program

Yukoners encouraged to apply for Northwestel's Northern Futures Scholarship Program

City of Whitehorse summer transportation maintenance work underway

City of Whitehorse summer transportation maintenance work underway

Yukon Government seeks input on new downtown public school

Yukon Government seeks input on new downtown public school

Indigenous leadership takes centre stage: Rebecca Chartrand and Mandy Gull-Masty appointed to key cabinet roles

Indigenous leadership takes centre stage: Rebecca Chartrand and Mandy Gull-Masty appointed to key cabinet roles

Whitehorse prepares for Annual 20-Minute makeover

Whitehorse prepares for Annual 20-Minute makeover

RCMP conducting training exercises on Schwatka Lake

RCMP conducting training exercises on Schwatka Lake